Product Selected - Alt DRX

What Does Alt DRX Do? (Elevator Pitch)

"Own Real Estate, One Square Foot at a Time – Starting at Just ₹10,000!"

Ever wanted to invest in real estate but found it too expensive or complicated? Alt DRX makes real estate investing easy, affordable, and flexible.

With our digital marketplace, you can own a fraction of premium properties starting from just ₹10,000—no huge upfront costs, no paperwork hassle. Invest in rental homes, hotels, warehouses, and more, earn passive income, and trade your shares whenever you want.

Core Value Proposition of Alt DRX

1️⃣ Accessibility & Affordability – Real estate for everyone! With fractional ownership starting at just ₹10,000, Alt DRX removes the high capital barrier, making premium real estate investments accessible to all.

2️⃣ Liquidity in Real Estate – Unlike traditional property investments that lock up capital, Alt DRX allows investors to buy, sell, and exit their real estate shares easily, just like stocks.

3️⃣ Diversification & Passive Income – Invest in multiple asset classes (rental homes, warehouses, hotels, etc.), earn passive rental income, and build a well-balanced portfolio with minimal risk.

4️⃣ Seamless Digital Experience – A fully tech-driven platform that simplifies investing, eliminating paperwork, brokers, and lengthy processes. Invest in minutes, track your portfolio, and trade with ease.

5️⃣ Secure & Transparent Transactions – Backed by strong regulatory compliance, smart contracts, and a trusted marketplace, ensuring safe, hassle-free investments with clear ownership rights.

💡 Alt DRX is redefining real estate investment—making it affordable, liquid, and accessible for everyone.

Ideal Customer Profiles

After Conducting 5 User interviews and speaking with Alt DRX team, here's my analysis and summary of the ICP Categorization.

Criteria | ICP 1 | ICP 2 |

|---|

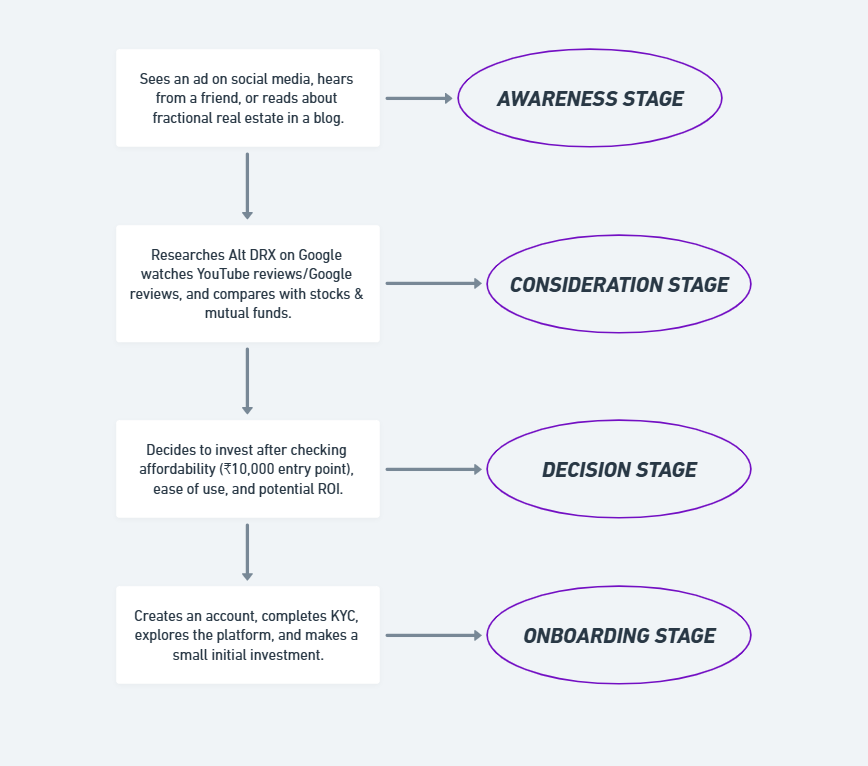

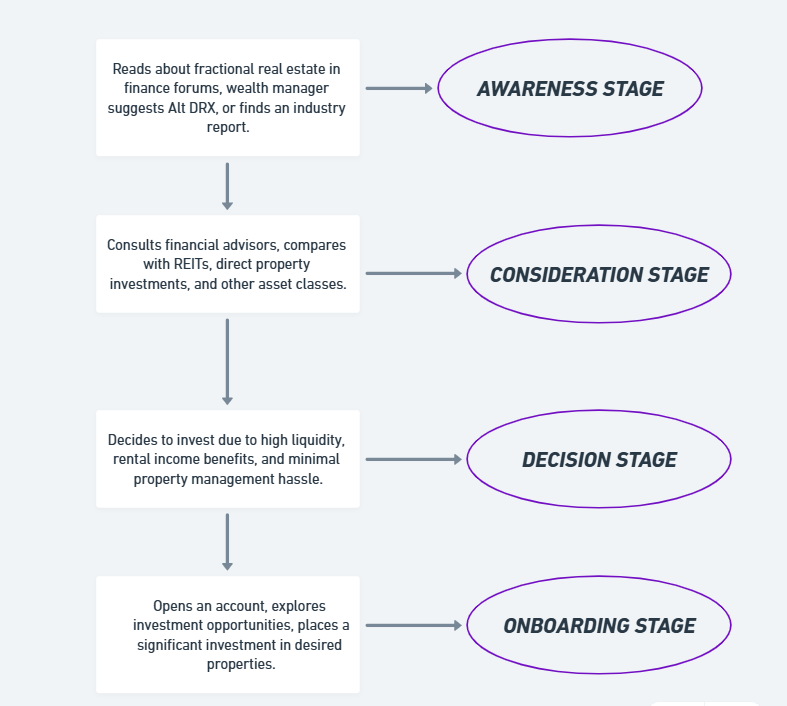

Type | Young Working Professionals (25-35) – First-Time Investors | HNIs & Affluent Investors (30-55) – Portfolio Diversifiers |

Who They Are | Mid-income salaried individuals (₹6-20LPA) in IT, banking, marketing, and creative fields, looking to invest beyond stocks & mutual funds. | High Net Worth Individuals (₹50LPA+), senior executives, business owners, and professionals looking for diversified real estate investments. |

Investment Motivation | Low entry barrier (₹10,000) makes real estate investing accessible | Seeking liquidity in real estate, passive rental income, and AIF's. |

How They Discovered Alt DRX | Mostly through social media ads, and finance blogs. | Mostly through finance forums, wealth managers, and direct research into fractional real estate investing. |

Features Important to them | User-friendly digital interface, real-time investment tracking, transparent property insights, and ease of entry. | Automated rental income distribution, ability to diversify across property types, and secondary market liquidity. |

Platform Usage Frequency | Check platform weekly or bi-weekly. Active investors log in frequently, while some rely on email updates. | Log in monthly or bi-monthly. Passive investors rely on rental payouts and NAV updates. |

Spending & Investment Behavior | Allocate 20-40% of their salary to investments, with a mix of stocks, mutual funds, and now Alt DRX. | Invest ₹25 lakh to ₹1 crore per year into alternative assets, including Alt DRX. |

What factors influence their investment decisions the most? | ROI and affordability are the biggest factors. They also have a lower tolerance for risk. | Liquidity and diversification are top priorities, followed by ROI. Passive income from rental yields is also important. |

What other investment options would they considering before choosing Alt DRX? | Mutual funds, stocks, FDs. | Direct real estate investment, REITs, alternative assets (gold, private equity). |

ICP Prioritization

Criteria | Adoption Rate | Appetite to Pay | Frequency of Use Case | Distribution Potential | TAM ( users) |

ICP 1 | High | Medium | High | High | High |

ICP 2 | High | High | High | Medium | High |

Reasoning for ICP 1 Prioritization

Young Working Professions (ICP 1) is prioritized due to its high adoption rate and frequent platform engagement. While their appetite to pay is medium, their lower ticket size expands the Total Addressable Market (TAM), making them a scalable segment.